2DII: New Climate Impact Management System opens for consultation

-

Project newsX

- Beta version by 2DII’s Evidence for Impact Program and ADEME, part of the European Commission-funded Finance ClimAct project, aims to help financial institutions design scientifically sound climate impact strategies

- offer feedback (by June 7th) and pilot test the framework

Recently, there has been a surge in financial sector initiatives focused on climate-related targets or strategies, with a number of big industry names making Net-Zero targets in the past few months alone.

However, some commitments have centered on targets that are decades away, with little clarity on the near-term actions that will be undertaken to meet these targets. Additionally, there has been limited focus on understanding howthese kinds of initiatives will contribute to impact – that is, greenhouse gas emissions reductions – in the real economy (see our previous report, On the Road to Paris).

The Climate Impact Management System aims to fill this gap, by providing FIs with a clear roadmap to develop, refine, and communicate on impactful climate strategies. The system was developed by 2DII’s Evidence for Impact Program and the French Ecological Transition Agency (ADEME), as part of the Finance ClimAct project.

Stakeholders are now invited to offer feedback (see below) by June 7th and/or participate in road-testing the framework.

More about the Climate Impact Management System

The Impact Management System is a framework that aims to assist FIs in setting up climate strategies specifically designed to maximize their contributions to climate change mitigation. The framework is primarily designed for financial institutions, but can also inform the development of labelling or certification schemes for financial products. It is particularly valuable for financial institutions that have undertaken long-term Net-Zero commitments and want to set up near-term plans to actively contribute to these commitments. The framework can be applied at the product, business line, or institutional level.

How to apply the Impact Management System?

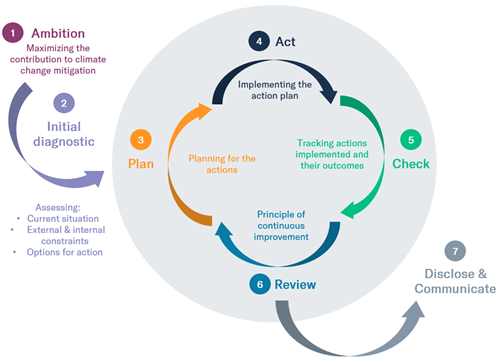

The Impact Management System consists of several steps, per the graphic below. First, it guides FIs in defining the best possible contribution that they can make to climate change mitigation, based on the available science and their specific constraints (steps 1 & 2). Then, it guides them in planning for this contribution (step 3) and monitoring it (steps 4 & 5). Step 6 outlines a process for continuous improvement of the contribution. Finally, step 7 offers guidance on how to communicate on the contribution and disclose the process.

Learn more, offer your feedback, and join the pilot testing phase (deadline: June 7th)

- View the full report here and 2-page summary here.

- Please send feedback via email, in whatever format you prefer, to Deputy Head of Impact Soline Ralite (soline@2degrees-investing.org); alternately, you may fill out this survey.

- Following the consultation, we will pilot test the framework with voluntary financial institutions prior to final release by autumn 2021. If you would like to join the pilot group, please contact Soline at the address above.